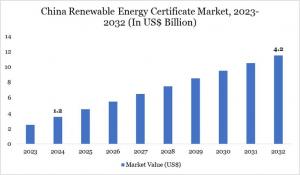

China Renewable Energy Certificate Market to Rise from $1.2B in 2024 to $4.2B by 2032, Driven by Energy Transition

China’s REC market grows on RPS mandates, expanding solar wind capacity, and rising corporate sustainability demands.

China’s REC surge reflects its deep commitment to clean energy, as policy strength and corporate demand reshape the nation’s green power landscape.”

AUSTIN, TX, UNITED STATES, November 28, 2025 /EINPresswire.com/ -- According to DataM Intelligence, the China renewable energy certificate market reached US$ 1.2 billion in 2024 and is projected to reach US$ 4.2 billion by 2032, growing with a CAGR of 14.2% during the 2025-2032 forecast period. Key drivers include China's leadership as the world’s largest renewable energy producer, government mandates like Renewable Portfolio Standards (RPS), and commitment to carbon neutrality by 2060. The market benefits from massive solar and wind capacity additions, with nearly 350 GW installed in 2023, fueling substantial REC generation.— Sai Teja Thota

𝗚𝗲𝘁 𝗮 𝗦𝗮𝗺𝗽𝗹𝗲 𝗣𝗗𝗙 𝗕𝗿𝗼𝗰𝗵𝘂𝗿𝗲 𝗼𝗳 𝘁𝗵𝗲 𝗥𝗲𝗽𝗼𝗿𝘁 (𝗨𝘀𝗲 𝗖𝗼𝗿𝗽𝗼𝗿𝗮𝘁𝗲 𝗘𝗺𝗮𝗶𝗹 𝗜𝗗 𝗳𝗼𝗿 𝗮 𝗤𝘂𝗶𝗰𝗸 𝗥𝗲𝘀𝗽𝗼𝗻𝘀𝗲):

https://www.datamintelligence.com/download-sample/china-renewable-energy-certificate-market

Key Highlights from the Report:

➤ China leads global renewable capacity, contributing nearly 60% of new additions by 2030, with solar dominating at 80% of growth.

➤ Government’s GEC program and August 2024 trading rules boost REC issuance and credibility as proof of green energy benefits.

➤ Pricing varies by source: hydro RECs at US$ 0.30/MWh, solar at US$ 0.80/MWh in 2023, influenced by demand from RE100 commitments.

➤ State-owned enterprises dominate generation, limiting private participation amid rising corporate sustainability goals.

➤ 14th Five-Year Plan targets accelerate clean energy shift, enhancing REC trading platforms.

Market Segmentation:

China’s Renewable Energy Certificate (REC) market is structured by certificate type and energy source, each shaping distinct growth pathways driven by policy mandates, renewable capacity expansion, and corporate sustainability commitments.

By Type:

I-REC (International Renewable Energy Certificate) represents a rapidly growing segment, primarily driven by multinational corporations, export-oriented manufacturers, and companies pursuing RE100 or science-based climate targets. I-RECs provide globally recognized verification and are preferred for cross-border ESG compliance, making them essential for enterprises engaged in international supply chains.

GEC (Green Electricity Certificate) China’s official compliance certificate constitutes the larger share of the market, supported by national Renewable Portfolio Standard (RPS) requirements. GECs are issued to renewable generators and purchased by utilities and industrial users to meet mandatory renewable consumption quotas. Increasing enforcement of provincial RPS scores continues to strengthen demand for GECs across China’s power and industrial sectors.

By Energy Source:

Solar RECs dominate the market, reflecting China’s world leading solar generation capacity and extensive photovoltaic deployment across central, eastern, and western provinces. Solar based certificates are widely used by corporates and utilities seeking cost effective compliance and voluntary procurement options.

Wind RECs form another major segment, supported by China’s large onshore and offshore wind bases, particularly in Inner Mongolia, Xinjiang, Gansu, and coastal provinces. Wind-based certificates are integral for industrial buyers aiming to diversify renewable sourcing portfolios.

Hydro RECs hold substantial value due to China’s long standing hydropower infrastructure in regions like Sichuan and Yunnan. These certificates are commonly used by utilities and large manufacturers seeking stable and high capacity renewable solutions.

Biomass RECs are emerging steadily, driven by circular economy initiatives and waste-to-energy programs. They support industries seeking renewable diversification and alignment with sustainability frameworks.

Geothermal RECs, while a smaller segment, represent a niche but increasingly strategic category, particularly as China expands its geothermal heating and power generation projects. Growing interest in low emission baseload energy solutions positions geothermal RECs as a promising future opportunity.

Looking For A Detailed Full Report? Get it here:

https://www.datamintelligence.com/buy-now-page?report=china-renewable-energy-certificate-market

Browse in-depth TOC on "China Renewable Energy Certificate Market"

40– Tables

30– Figures

176 – Pages

Regional Insights:

Regional dynamics in China’s Renewable Energy Certificate (REC) market are shaped by variations in industrial activity, renewable energy capacity, and provincial policy frameworks:

East China, including major economic hubs like Jiangsu, Zhejiang, and Shanghai, represents the largest share of the REC market due to its strong manufacturing base, high electricity consumption, and aggressive corporate sustainability commitments. The region’s dense industrial clusters make it a key driver of voluntary REC purchases.

North China, led by provinces such as Inner Mongolia, Hebei, and Shanxi, plays a critical role as a supply powerhouse. Abundant wind and solar resources have positioned this region as a major generator of renewable electricity, contributing significantly to REC availability.

Southwest and Northwest China including Yunnan, Sichuan, Xinjiang, and Gansu are emerging as major contributors, supported by large scale hydropower, solar, and wind installations. These regions benefit from government backed projects that enhance renewable generation and grid connectivity.

Market Dynamics:

Market Drivers:

Rapid energy transition, with solar/wind leading global additions, propels REC demand under RPS and GEC mandates. Policy support like the 14th Five Year Plan and carbon neutrality targets drive investment, alongside declining renewable costs. Corporate pledges (e.g., RE100) and state owned generation scale boost trading volumes.

Market Restraints:

Lack of transparency, standardization, and third party verification hinders buyer confidence and risks double counting. State dominance limits private entry, with inconsistent pricing and policy enforcement capping mature market growth.

Market Opportunities:

Localizing REC platforms, enhancing verification, and expanding voluntary markets offer growth amid Asia-Pacific cooperation. R&D in tracking tech and international I-REC alignment can attract global buyers.

Get Customization in the report as per your requirements:

https://www.datamintelligence.com/customize/china-renewable-energy-certificate-market

Reasons to Buy the Report:

✔ Comprehensive market size analysis with forecasts to 2032, providing reliable data for strategic planning.

✔ Detailed segmentation analysis that helps stakeholders identify high-growth niche markets.

✔ Key insights on regulatory trends like GEC rules, essential for compliance and trading strategies.

✔ Expert coverage of policy shifts, pricing dynamics, and platform developments.

✔ Inclusion of actionable trends and opportunities for traders, utilities, and policymakers.

Frequently Asked Questions (FAQs)

◆ How big is the China Renewable Energy Certificate (REC) Market?

The China Renewable Energy Certificate (REC) Market is expanding rapidly, driven by national decarbonization commitments, mandatory Renewable Portfolio Standards (RPS), and accelerating renewable power deployment across the country. The market is projected to grow substantially through 2031 as utilities, heavy industries, and multinational corporations increase their reliance on both compliance and voluntary RECs to meet renewable energy consumption targets. Strong policy backing, massive solar and wind additions, and the rise of digital trading platforms are key contributors to market expansion. Compliance RECs continue to dominate, supported by provincial government mandates and grid-level renewable consumption obligations.

◆ What are the key drivers of the China Renewable Energy Certificate Market growth?

Key growth drivers for the China REC market include the enforcement of the national Renewable Portfolio Standard (RPS), which compels utilities and major industrial energy users to procure RECs to meet mandated renewable consumption quotas. China’s aggressive carbon neutrality goals for 2060, combined with expanding solar, wind, and hydropower capacity, significantly boost certificate availability and adoption. Corporate ESG commitments especially among export oriented manufacturers and multinational enterprises further accelerate voluntary REC purchases. Additionally, advancements in digital REC tracking, green power trading platforms, and bundled green PPA + REC models are enhancing transparency, reducing administrative barriers, and strengthening REC market liquidity nationwide.

Key Players:

China Green Certificate Trading Platform, I-REC Standard, APX Inc., Beijing Power Exchange Center, Shanghai Environment and Energy Exchange (SEEE), and Climate Bridge (Shanghai) Ltd.

Highlights:

China Green Certificate Trading Platform maintains a leading position in the national compliance REC ecosystem, facilitating over 60% of certificate issuances and transactions under China’s Renewable Portfolio Standard (RPS). Its centralized system is widely adopted by provincial grid operators and renewable power producers to ensure regulatory compliance and transparent certificate tracking.

I-REC Standard and APX Inc. together account for a rapidly growing share of China’s voluntary REC market, enabling international corporates and export-oriented manufacturers to source globally recognized certificates. Their digital registries support cross-border traceability, helping China-based firms meet RE100, SBTi, and global ESG requirements.

Shanghai Environment and Energy Exchange (SEEE) reported a 17% year-over-year increase in green power and REC-linked trading volumes in 2024, driven by expanding participation from industrial clusters in Shanghai, Jiangsu, and Zhejiang. The exchange plays a pivotal role in bundling green PPAs with RECs, enhancing market liquidity and corporate adoption.

Recent Developments:

-In November 2025, China’s National Energy Administration (NEA) conducted the Annual Renewable Energy & Green Power Trading Forum in Beijing, emphasizing the expansion of the national Renewable Portfolio Standard (RPS) and the integration of digital REC tracking systems. The event showcased advancements in blockchain enabled REC verification, cross provincial green power trading mechanisms, and upgraded certificate auditing protocols aimed at improving market transparency and compliance across utilities and industrial buyers.

-In October 2025, several key industry gatherings including the China Green Energy Market Exchange (CGEME) and the International Clean Energy & Sustainability Summit (ICESS) held in Shanghai brought together policymakers, renewable project developers, and corporate energy buyers. These conferences highlighted breakthroughs in REC digitalization, bundled green PPA + REC models, and cross border renewable certificate alignment within the Asia-Pacific region. Discussions also centered on China’s roadmap for scaling voluntary REC markets to support corporate decarbonization and export driven ESG requirements.

Conclusion:

China’s renewable energy certificate market surges with policy-driven renewable dominance and trading reforms. Amid energy transition challenges, GEC enhancements and corporate demand position stakeholders for sustained expansion. Investors, utilities, and platforms converge to meet global green goals, reinforcing China’s clean energy leadership.

Related Reports:

Renewable Energy Certificate Market : Expected to Grow at 2.6% CAGR Through 2032 as Adoption of Market Based Renewable Energy Solutions Strengthens

Cambodia renewable energy certificate Market :Expected to Grow at 2.6% CAGR Through 2032 as Demand for Renewable Energy Tracking & Compliance Solutions Rises

Sai Kiran

DataM Intelligence 4market Research LLP

+1 877-441-4866

sai.k@datamintelligence.com

Visit us on social media:

LinkedIn

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.