State Investment Platform: How State Investment Platform Emerges as a Leading AI Trading Platform, Reports Highlight Features & Innovation

State Investment Platform – An AI-powered trading platform with real-time analytics, automation, and secure multi-asset access for smarter global investing.

New York City, NY, Oct. 24, 2025 (GLOBE NEWSWIRE) -- What Is State Investment Platform?

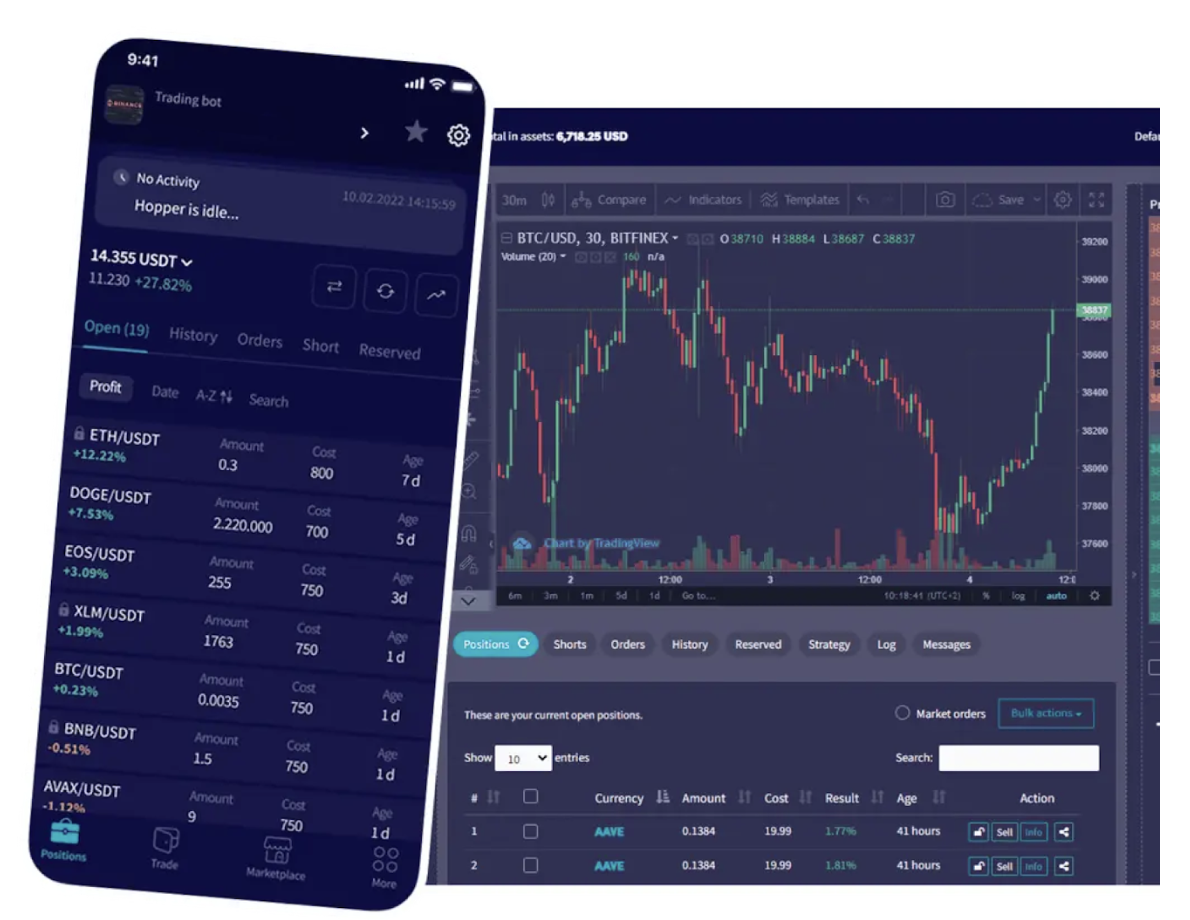

State Investment Platform is a next-generation financial technology platform that integrates artificial intelligence with automated trading systems to redefine digital asset management. Designed for precision, scalability, and real-time execution, State Investment Platform enables traders to participate in global markets such as forex, and commodities through one unified interface. The platform combines machine learning algorithms with data-driven analytics to optimize trade timing, minimize human error, and maximize efficiency.

At its core, State Investment Platform utilizes an advanced algorithmic engine that continuously analyzes thousands of market variables simultaneously. This AI engine identifies trading patterns, predicts potential price movements, and executes transactions based on real-time analytics. Its infrastructure supports both high-frequency and low-latency trading, ensuring that orders are processed with speed and accuracy.

State Investment Platform’s architecture is built for reliability and transparency, adhering to strict compliance protocols across global jurisdictions. It offers full integration with reputable financial brokers, ensuring every transaction remains traceable and secure. Through its adaptive AI framework, the platform supports diverse investment strategies, from conservative portfolio management to data-intensive day trading. With a focus on automation, State Investment Platform empowers traders to operate efficiently in an ever-evolving market landscape without manual monitoring or intervention.

Join State Investment Platform Now – Visit Official Website Now

Key Features of State Investment Platform

State Investment Platform’s features are designed to create a seamless intersection between human decision-making and artificial intelligence. The foundation of its ecosystem lies in real-time market analytics, enabling users to view, track, and respond to live price fluctuations across multiple markets. This live data analysis ensures that the platform’s algorithmic trading system executes buy or sell actions at optimal market entry points.

Smart automation forms another crucial pillar. The platform allows traders to establish pre-configured strategies, enabling automatic execution once certain conditions are met. State Investment Platform’s automation engine constantly adapts to market volatility, ensuring that trades remain aligned with both short-term and long-term objectives. By leveraging predictive AI modeling, it minimizes emotional decision-making and maximizes analytical consistency.

State Investment Platform also offers multi-asset access, providing exposure to cryptocurrencies, forex, indices, and commodities within a single, unified dashboard. This multi-market integration reduces the need for external accounts, improving efficiency and liquidity management. Furthermore, the system’s intuitive interface supports advanced charting tools, technical indicators, and instant trade notifications. Together, these features form a cohesive AI-powered ecosystem optimized for speed, accuracy, and accessibility.

Visit the Official State Investment Platform Website Now

Register on the State Investment Platform trading application

State Investment Platform Account Setup Process – Step by Step

State Investment Platform simplifies onboarding through a structured and transparent registration process that accommodates both new and experienced traders.

Step 1 – Registration:

Visit the official State Investment Platform website and fill in the registration form with accurate details such as full name, email, and contact number.

Step 2 – Account Verification:

A verification email or phone confirmation ensures that user credentials meet compliance requirements under financial data protection standards.

Step 3 – Minimum Deposit Requirement:

Once verified, users can activate trading functions by funding their account. The minimum deposit requirement varies based on jurisdiction but is typically within a moderate entry range, ensuring accessibility while maintaining risk control.

Step 4 – Broker Integration:

The platform automatically connects to a verified brokerage partner, providing users with access to multiple trading instruments and live data feeds.

Step 5 – Dashboard Activation:

Upon funding, the trading dashboard unlocks, giving users access to real-time analytics, AI-driven automation tools, and portfolio management controls.

Step 6 – Start Trading:

Users can begin automated or manual trading, adjust strategy parameters, and track performance metrics directly through the platform interface.

This structured process ensures operational clarity, transparency, and seamless access to AI-powered trading within minutes.

How State Investment Platform Uses Algorithmic Intelligence to Execute Profitable Trades

State Investment Platform integrates algorithmic intelligence as its operational backbone, combining predictive analytics with rule-based execution. The AI models continuously scan global financial markets, analyzing historical data patterns and real-time price feeds. By identifying high-probability entry and exit points, the algorithm minimizes exposure to volatile swings and maximizes efficiency.

The system operates autonomously but remains fully configurable. Traders can set parameters like risk tolerance, preferred asset categories, and trading timeframes. Once configured, the AI dynamically adjusts its approach in response to shifting market signals. State Investment Platform’s machine learning engine evaluates thousands of potential outcomes every second, filtering noise from meaningful patterns that influence trade direction.

Its execution module utilizes advanced order routing to ensure that transactions occur at the most favorable available price. This eliminates manual delays and human bias. Furthermore, the AI continuously learns from outcomes, recalibrating models for improved accuracy. This self-evolving mechanism ensures that State Investment Platform’s algorithmic structure remains adaptive, consistent, and capable of identifying profitable trade opportunities across volatile markets — all while maintaining strict risk management boundaries.

Unlock smarter trading with State Investment Platform — Visit the Official Website Here

AI Intelligence Behind State Investment Platform

The intelligence layer of State Investment Platform is powered by deep-learning neural networks capable of processing massive datasets. These models simulate human reasoning but operate at computational speeds unmatched by manual analysis. The AI reviews global market conditions, liquidity fluctuations, sentiment indices, and macroeconomic variables to forecast potential price behaviors.

Unlike static systems, State Investment Platform’s machine learning architecture is self-optimizing. It evolves through continuous exposure to live and historical data. Each completed trade feeds back into the system, refining its predictive accuracy and strategy calibration. The more the algorithm trades, the more precise its future predictions become.

This closed feedback loop enhances trade execution efficiency and minimizes latency-related errors. State Investment Platform also employs natural language processing (NLP) to interpret market news and integrate real-time sentiment into its trading models. This fusion of quantitative and qualitative analytics allows the platform to make data-driven decisions with remarkable precision. By merging automation with adaptive intelligence, State Investment Platform delivers a future-ready AI framework that ensures performance optimization under all market conditions.

Visit the Official State Investment Platform Website Now

Deposits & Withdrawals – Fast, Seamless, and Fully Secure Transactions

State Investment Platform ensures a frictionless transaction experience supported by encrypted payment gateways and blockchain-backed verification layers. Deposits are processed instantly through multiple payment options, including debit/credit cards, bank transfers, and select digital wallets. Each transaction passes through secure SSL-encrypted servers, ensuring data confidentiality and preventing unauthorized access.

Withdrawals follow a similarly structured process. Once a withdrawal request is initiated, the platform performs a two-step authentication to validate identity and account ownership. This ensures compliance with anti-money laundering (AML) standards and international transaction policies. Most withdrawals are processed within 24 hours, depending on payment channel and regional banking systems.

State Investment Platform’s financial framework emphasizes transparency, offering complete visibility into deposit and withdrawal history via the user dashboard. All transactions are logged in real time and remain accessible for review. This robust infrastructure ensures that every monetary movement within the ecosystem is both traceable and compliant. By prioritizing transaction integrity, State Investment Platform reinforces user trust through financial precision and operational accountability.

Why Choose State Investment Platform? Canada Consumer Report Released Here

State Investment Platform Demo Mode

The demo mode within State Investment Platform functions as a simulated trading environment that mirrors real market dynamics without financial exposure. It allows users to explore platform tools, test strategies, and analyze AI execution patterns before transitioning to live trading. This feature is particularly valuable for users learning how automation and algorithmic intelligence function in real-time conditions.

State Investment Platform’s demo environment uses live market data, ensuring authenticity in trade simulations. Users can observe how the AI reacts to volatility, executes entry and exit points, and applies risk management protocols. Every function, from charting to automated triggers, operates identically to the live version—only without actual capital at stake.

Through the demo mode, users can adjust algorithm parameters, optimize strategy configurations, and evaluate performance metrics. This hands-on practice environment fosters technical familiarity while reducing operational risk. State Investment Platform’s inclusion of this mode underscores its commitment to education, transparency, and responsible trading integration within the AI ecosystem.

State Investment Platform – Cost, Minimum Deposit, and Profit

State Investment Platform’s financial model is structured for flexibility and accessibility. The minimum deposit requirement remains modest, ensuring traders of all experience levels can access automated features without significant capital barriers. While the exact threshold may vary by region, it typically aligns with standard industry practices for AI-driven trading platforms.

Operational costs are transparent, with no hidden transaction fees. The platform may apply minimal service charges for broker integration or withdrawal processing, depending on payment method and jurisdiction. State Investment Platform emphasizes full disclosure of all financial terms during the onboarding process to maintain user trust.

Profit generation is driven by algorithmic efficiency rather than speculative risk. The AI continuously evaluates and rebalances portfolios based on real-time data, ensuring optimized exposure. Although returns fluctuate with market conditions, State Investment Platform’s core design prioritizes consistency, data precision, and long-term sustainability. This balanced approach distinguishes its framework as one built on measurable performance rather than short-term speculation.

Why Choose State Investment Platform? Canada Consumer Report Released Here

Countries Where State Investment Platform Is Legal

State Investment Platform maintains compliance across multiple jurisdictions through partnerships with regulated brokers and adherence to financial governance standards. It operates legally in the United Kingdom, Canada, Australia, select European Union countries, and various regions in Asia and Latin America. Each jurisdiction’s accessibility depends on local trading laws and digital asset regulations.

The platform’s operational structure is designed to meet regional compliance standards, including Know Your Customer (KYC) and Anti-Money Laundering (AML) directives. By integrating with brokers licensed under regional authorities, State Investment Platform ensures that its users engage within legally approved frameworks.

For countries with restrictions on certain asset classes, State Investment Platform automatically adjusts available trading options to comply with local rules. This adaptable legal architecture underscores the platform’s global reach while maintaining regulatory responsibility. The legal availability of State Investment Platform reflects its dedication to transparent, compliant, and ethically governed trading practices worldwide.

Visit the Official State Investment Platform Website Now

State Investment Platform Supported Assets

State Investment Platform provides multi-asset access, enabling users to diversify portfolios through one intelligent platform. Supported assets include cryptocurrencies (such as Bitcoin, Ethereum, and major altcoins), forex pairs, global indices, and select commodities. This broad spectrum allows traders to manage diversified exposure without switching platforms or accounts.

Each asset class operates within its own data stream, allowing State Investment Platform’s AI to apply asset-specific algorithms. For example, cryptocurrency markets are analyzed using volatility clustering and blockchain sentiment data, while forex relies on macroeconomic indicators and price correlations. This differentiation enhances precision and mitigates risk.

Additionally, State Investment Platform’s infrastructure supports cross-market insights—helping traders recognize opportunities driven by correlations between asset movements. All supported instruments are accessible via an intuitive dashboard that includes real-time data charts, analytical overlays, and portfolio management tools. This multi-market versatility empowers users to manage assets effectively under one unified AI system.

Global Access & 24/7 Support

State Investment Platform operates with global accessibility, allowing users to connect and trade around the clock, regardless of time zone. Its cloud-based architecture ensures continuous uptime, while multi-language support enables inclusivity for traders across continents.

The platform’s 24/7 customer support structure is powered by a dedicated technical team available via chat, email, and secure ticketing systems. Assistance covers technical issues, account queries, and operational guidance, ensuring seamless communication between users and platform representatives.

Discover How State Investment Platform is Helping Thousands Achieve Financial Freedom Online

Risk Management, Demo Mode & Customizable Strategies Explained

Effective risk management is central to State Investment Platform’s AI framework. The platform incorporates automated stop-loss functions, adjustable leverage settings, and dynamic margin monitoring to safeguard capital during volatile market conditions.

Customizable trading strategies allow users to define parameters such as trade size, frequency, and risk ratio. The AI adheres strictly to these inputs, ensuring full control over exposure levels. Moreover, its real-time monitoring tools detect anomalies or irregular trading patterns, immediately triggering protective mechanisms to minimize potential losses.

The built-in demo mode complements this system by allowing traders to test risk profiles in a safe environment before committing real funds. Every configuration can be backtested using live data, giving users empirical insights into potential outcomes. This integration of risk controls, customizable automation, and simulation functionality reflects State Investment Platform’s commitment to precision, safety, and informed trading across diverse markets.

Security Protocols & Broker Partnerships Behind State Investment Platform

State Investment Platform’s security framework employs multi-layered protection mechanisms to safeguard both user data and financial transactions. All communication between the user interface and servers is secured through 256-bit SSL encryption. Additionally, the platform implements two-factor authentication (2FA) and continuous intrusion detection systems to prevent unauthorized access.

Beyond digital security, State Investment Platform collaborates exclusively with verified broker partners who operate under licensed jurisdictions. Each partner undergoes periodic audits to ensure compliance with financial conduct standards and operational transparency.

Data privacy policies comply with GDPR and other international data protection frameworks, ensuring user information remains confidential and never shared with third parties without consent. Regular security audits and penetration testing further reinforce the system’s reliability. Collectively, these measures demonstrate State Investment Platform’s dedication to creating a secure, compliant, and trust-centered AI trading infrastructure.

Final Verdict – State Investment Platform 2025: Trusted by Traders, Powered by AI

State Investment Platform represents a milestone in the evolution of AI-driven finance. Built on a foundation of automation, data precision, and global compliance, it delivers a technologically advanced solution for modern traders seeking accuracy and operational efficiency.

The platform’s deep-learning architecture, transparent data metrics, and verified brokerage integrations highlight its position as an institutional-grade trading ecosystem. Its modular design supports continual upgrades, ensuring adaptability to emerging financial technologies and regulatory landscapes.

With a focus on innovation, scalability, and ethical transparency, State Investment Platform continues to shape the digital investment environment for 2025 and beyond. It merges the analytical power of machine learning with the dependability of secure infrastructure — establishing itself as a forward-thinking force in algorithmic trading and AI-based financial systems.

Visit the Official State Investment Platform Website Now

Contact:-

State Investment Platform

485 Bd de la Gappe, Gatineau, QC J8T 5T9, Canada

Email: support@stateinvestmentplatform.ca

Website: https://stateinvestmentplatform.com/

General Disclaimer:

The content provided in this article is for informational and educational purposes only. It does not constitute financial, legal, or professional advice. Readers are advised to consult a certified financial advisor, licensed loan officer, or legal professional before making any financial decisions. The information presented may not apply to every individual circumstance and is not intended to substitute professional judgment or regulatory guidance. The information provided on this website does not constitute investment advice, financial advice, trading advice, or any other sort of advice and you should not treat any of the website's content as such. We does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.

Trading Disclaimer:

Trading cryptocurrencies carries a high level of risk, and may not be suitable for all investors. Before deciding to trade cryptocurrency you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with cryptocurrency trading, and seek advice from an independent financial advisor. ICO's, IEO's, STO's and any other form of offering will not guarantee a return on your investment.

RISKS ASSOCIATED WITH FUTURES TRADING

Futures transactions involve high risk. The amount of the initial margin is low compared to the value of the futures contract, so that transactions are "leveraged" or "geared". A relatively small market movement has a proportionately larger impact on the funds that you have deposited or have to pay: this can work both for you and against you. You may experience the total loss of the initial margin funds as well as any additional funds deposited in the system. If the market develops in a way that is contrary to your position or if margins are increased, you may be asked to pay significant additional funds at short notice to maintain your position. In this case it may also happen that your broker account is in the red and you thus have to make payments beyond the initial investment.

Syndication Partner Use:

This content may be republished or syndicated by authorized partners under existing licensing or distribution arrangements. All syndication partners are free from liability regarding the editorial stance, financial suggestions, or any user outcome resulting from the reading or application of this content.

Related Links

Meteor Profit

Attachment

Contact:- State Investment Platform 485 Bd de la Gappe, Gatineau, QC J8T 5T9, Canada Email: support@stateinvestmentplatform.ca Website: https://stateinvestmentplatform.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.