MSBFUND Announces Strategic BTC Reserve Cooperation with Top Global Institutions, Building a Crypto Version of "Central Bank Foreign Exchange System"

Los Angeles, CA, Sept. 25, 2025 (GLOBE NEWSWIRE) -- Global compliant digital asset trading platform MSBFUND.com has officially announced a strategic cooperation agreement with three leading international asset management institutions. Together, they will promote the construction of the platform's BTC reserve pool, forming a strategic BTC reserve system with a scale exceeding $1 billion, creating a new "quasi-central bank" reserve framework aimed at the global digital economy.

According to the agreement, the reserve pool will adopt a joint custody mechanism, with the platform and partners establishing a multi-signature wallet system. This will be complemented by on-chain verification tools and a quarterly audit mechanism to ensure asset transparency, compliance, and security. This system will provide stable support for the platform during market fluctuations and serve as a foundational credit anchor for future stablecoin issuance, compliant asset securitization, and cross-border clearing.

MSBFUND's management stated, “We aim to help the digital asset industry build its own value reserve foundation, providing the market with a level of underlying security and stability comparable to traditional central bank foreign exchange reserve systems.”

Multi-Layer Reserve System, Building a Risk-Resistant Moat

This strategic cooperation marks the official entry of MSBFUND's BTC reserve strategy into its second phase, evolving from "platform self-holding" to "multi-institutional joint reserves." Over the next two years, the platform will leverage Grayscale's asset management capabilities and the custody technology and on-chain security systems of the three institutions to gradually build a BTC strategic asset pool exceeding $1 billion.

The asset pool will feature a three-tier reserve structure, including:

- · Basic Reserve Pool: To meet daily market operations and liquidity needs.

- · Emergency Reserve Pool: To quickly respond to systemic risks and severe market fluctuations.

- · Stability Mechanism Pool: To support the stability of the platform's stablecoin pegs, on-chain lending, payment clearing, and other stability scenarios.

Through this mechanism, MSBFUND aims to provide a quasi-central bank-level asset trust system for global users and ecosystem developers, advancing digital financial infrastructure into a new phase of stability, compliance, and long-term development.

MSBFUND X API Modular System Launches, Exchange Capabilities Open to the Public

To further unleash the platform's capabilities, MSBFUND simultaneously released the MSBFUND X API modular service system, fully opening its core underlying trading and risk control capabilities to compliant institutions, quantitative trading teams, and DeFi developers. Core functionalities include:

- · Matching Trading API: Supporting matching capabilities of up to one million transactions per second under high concurrency.

- · Account and Clearing API: Supporting multi-currency and cross-account asset transfers and settlements.

- · Identity Verification and Risk Control Modules: Supporting KYC, AML compliance links, and AI scoring model integration.

- · Reserve Verification Module: Allowing access to reserve status and on-chain audit mechanisms.

Developers can utilize MSBFUND's trading matching, asset management, and risk control verification capabilities without needing to manage funds directly, enabling them to create their own compliant financial products or DeFi service modules, truly realizing "Exchange-as-a-Service."

AI Smart Risk Control 2.0 Released, Verified Through Global Regulatory Sandbox

At the same time, MSBFUND announced that its AI risk control system version 2.0 has officially launched. This system enables real-time account behavior modeling, intelligent risk scoring, and automatic freezing, and has passed the AI regulatory sandbox tests by Singapore's financial regulators, becoming one of the first AI risk control systems globally to receive compliance verification in multiple countries.

Key features include:

- · Behavioral Profiling Recognition: Dynamically tracking user behavior anomalies through machine learning models.

- · Risk Level Scoring: Providing alerts for potential violations, high-frequency behaviors, and money laundering pathways.

- · System-Level Response Mechanism: Implementing synchronized blacklisting, trading permission freezing, and risk account marking.

- · High Compatibility: Able to be embedded in various business modules, including DApps, payment systems, and stablecoin clearing paths.

The system is currently applied to MSBFUND's entire risk control framework, covering over 95% of asset pathways, significantly enhancing the platform's security and compliance levels.

MSBFUND's Global Layout Progressing Steadily

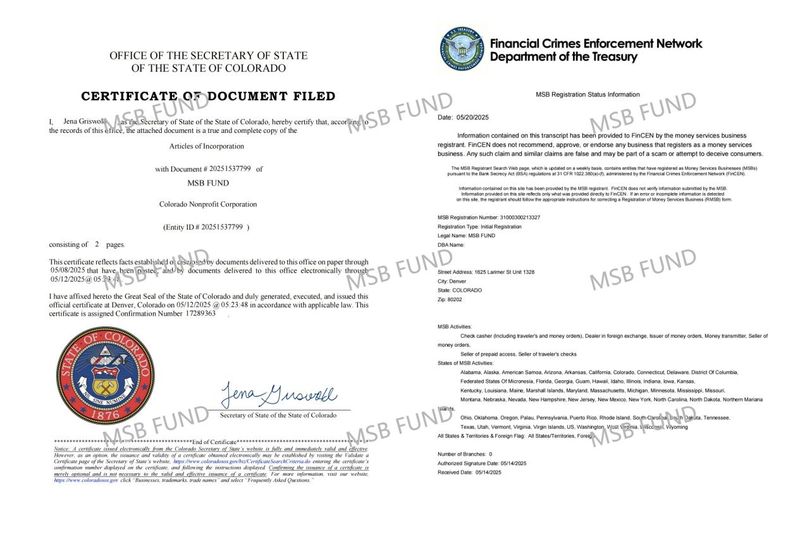

Currently, MSBFUND has obtained U.S. MSB and SEC registration licenses and completed the establishment of local compliance structures in regions such as Singapore, Dubai, Hong Kong, and Switzerland. The platform continues to advance its global layout, gradually constructing a new digital financial ecosystem that spans regions, chains, and asset classes centered around the four core principles of compliance, safety, efficiency, and transparency.

The platform implements a 1:1 asset reserve system, with all user assets held in compliant financial institution accounts and independent cold/hot wallet systems, subject to regular audits by international auditing firms to ensure the security of user funds.

Media Contact

Company Name: MSB FUND

Contact: Robert V. Adams

Website: https://msbfund.com

Email: Robert@msbfund.com

Disclaimer: The information provided in this press release is not a solicitation for investment, nor is it intended as investment advice, financial advice, or trading advice. Investing involves risk, including the potential loss of capital. It is strongly recommended you practice due diligence, including consultation with a professional financial advisor, before investing in or trading cryptocurrency and securities. Neither the media platform nor the publisher shall be held responsible for any fraudulent activities, misrepresentations, or financial losses arising from the content of this press release.

Robert V. Adams MSB FUND Robert at msbfund.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.