Global Fraud Detection and Prevention Market Poised for Exponential Growth, Projected to Reach $246.16 Billion by 2032

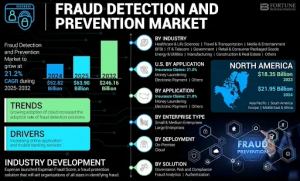

The global fraud detection and prevention market is valued at USD 52.82 Bn in 2024 and expected to reach USD 246.16 Bn by 2032, growing at a CAGR of 21.2%.

North America led the market with a 41.56% share in 2024, with the U.S. fraud detection and prevention market projected to hit USD 53,359.7 million by 2032.”

PUNE, MAHARASHTRA, INDIA, September 25, 2025 /EINPresswire.com/ -- The global fraud detection and prevention market is experiencing unprecedented growth momentum, projected to grow from USD 63.90 billion in 2025 to USD 246.16 billion by 2032, exhibiting a CAGR of 21.2% during the forecast period, according to Fortune Business Insights' latest comprehensive market analysis. The market was valued at USD 52.82 billion in 2024, demonstrating robust expansion as organizations worldwide prioritize cybersecurity investments.— Fortune Business Insights

Get a Free Sample Research PDF: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/fraud-detection-and-prevention-market-100231

Regional Dominance and Geographic Expansion

North America dominated the global market with a share of 41.56% in 2024, establishing itself as the leading region for fraud detection and prevention solutions adoption. The region's dominance stems from advanced digital infrastructure, high internet penetration rates, and increasing regulatory compliance requirements across various industries.

Asia Pacific is expected to grow at the highest CAGR during the forecast period (2025-2032), driven by rapid digitalization initiatives in manufacturing sectors across China, Japan, India, South Korea, and Southeast Asian countries. These emerging markets are witnessing substantial investments in fraud prevention technologies as businesses adapt to digital transformation challenges.

Europe maintains a significant market position with steady growth anticipated throughout the forecast period, particularly in government, manufacturing, and healthcare sectors across France, Germany, Italy, Spain, and other European nations.

Technology Adoption Driving Market Evolution

The market's growth trajectory is fundamentally shaped by technological advancement and deployment preferences. The cloud segment dominated the market in 2024 and is estimated to showcase highest CAGR during forecast period due to advancements in artificial intelligence, and data analytics. Cloud-based solutions are particularly attractive to small and medium-sized enterprises, which represent a rapidly expanding customer segment.

Authentication solutions continue to gain prominence within the fraud detection ecosystem. The authentication segment is expected to capture a large market share in 2024, offering enhanced security layers that make unauthorized access significantly more challenging. This trend reflects organizations' increasing emphasis on multi-layered security approaches.

Industry Application and Market Dynamics

The BFSI segment dominated the market in 2024 as fraudulent activities are surging in the BFSI sector due to digitalization. Banking and financial services institutions face escalating threats as cybercriminals develop sophisticated methods to compromise customer identities and access personal accounts. The sector's substantial investment in fraud prevention technologies reflects the critical importance of maintaining customer trust and regulatory compliance.

The healthcare & life sciences segment is expected to register highest CAGR during the forecast period owing to the growing demand for fraud analytics and authentication solutions and services. Healthcare organizations increasingly recognize the need for robust fraud detection capabilities to protect sensitive patient data and prevent fraudulent insurance claims.

The electronic payment application segment maintains market leadership, driven by exponential growth in online transactions and digital payment adoption globally. Rising e-commerce activity and mobile banking services have created new vulnerabilities that require sophisticated fraud detection capabilities.

Connect With Our Expert for any Queries: https://www.fortunebusinessinsights.com/enquiry/speak-to-analyst/100231

Enterprise Adoption Patterns

The Small & Medium Enterprises (SMEs) segment is anticipated to grow at a highest CAGR during the projection period, reflecting increasing security awareness among smaller organizations. This growth is attributed to rising startup activity across various geographic markets and the availability of cost-effective, cloud-based fraud detection solutions tailored for smaller enterprises.

Large enterprises continue to represent the dominant market segment by revenue, driven by comprehensive security requirements and substantial technology budgets. However, the democratization of fraud detection technologies through cloud deployment models is expanding market accessibility.

Market Challenges and Opportunities

Despite robust growth prospects, the market faces certain challenges that could impact expansion rates. The lack of professionals and a skilled workforce to update the FDP solutions across the emerging countries is expected to hinder the growth of the market. This skills gap represents both a challenge and an opportunity for solution providers to develop user-friendly platforms that require minimal technical expertise.

Additionally, limited awareness and acceptance across developing nations in regions including the Middle East, Africa, and parts of South America present growth constraints that market participants must address through education and localized solution development.

Competitive Landscape and Innovation Focus

The fraud detection and prevention market features intense competition among established technology leaders and innovative startups. Major market participants including IBM Corporation, ACI Worldwide, BAE Systems, Experian Information Solutions Inc., Fair Isaac Corporation, LexisNexis, and SAS Institute Inc. are actively pursuing geographical expansion and strategic partnerships to strengthen their market positions.

These industry leaders are focusing on developing advanced analytics capabilities, machine learning algorithms, and artificial intelligence-powered detection systems to stay ahead of evolving fraud techniques. The emphasis on real-time detection and response capabilities continues to drive innovation across the competitive landscape.

Future Market Outlook

The fraud detection and prevention market's growth trajectory reflects the fundamental shift toward digital business operations and the corresponding need for sophisticated security measures. As organizations continue embracing digital transformation initiatives, the demand for comprehensive fraud detection capabilities will intensify, supporting sustained market expansion through 2032.

The convergence of emerging technologies including artificial intelligence, machine learning, big data analytics, and blockchain technology promises to reshape fraud detection capabilities, offering more precise, efficient, and proactive security solutions for organizations across all industries and geographic regions.

𝐑𝐞𝐥𝐚𝐭𝐞𝐝 𝐑𝐞𝐩𝐨𝐫𝐭:

Digital Payment Market Size, Share & Growth, 2032

Social Media Analytics Market Size, Share & Growth, 2032

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.